How Many Types Of Interest Calculation.

INTEREST CALCULATION

INTEREST CALCULATION

Interest calculation is the mode of charge interest on whole or outstanding balance.

There are two types of interest calculation:-

1) Simple Interest Calculation

2) Compound Interest Calculation

Simple Interest Calculation: - Simple Interest Calculation, interest is charged on outstanding balance at the same rate of interest.

It is also of two types:-

a) Simple Outstanding Interest Calculation

b) Simple Invoicing Interest Calculation

Compound Interest Calculation: - in Compound Interest Calculation, interest is charged on whole instalment at different rate of interest.

It is also of two types:-

a) Compound Outstanding Interest Calculation

b) Compound Invoicing Interest Calculation

The methods to record these interest calculations are given in the next topics. Follow that steps and record in tally to work on it.

SIMPLE INVOICING INTEREST CALCULATION

SIMPLE INVOICING INTEREST CALCULATION

When a trader sales goods to any party on credit basis then he charges interest on the outstanding balance.

If the party refunds cash by instalment, then the trader charges same interest on all instalments. It is called simple invoicing interest calculation.

Example:-

Ram sold 3 pieces of HCL Computer to Arun for Rs. 10,000 each on credit basis. He decided to divide the total amount in three instalments and charge 5 % interest on it.

Maintain the above transaction.

To maintain:-

Create a company and then activate bill wise details, interest calculation and debit/credit note as follow:-

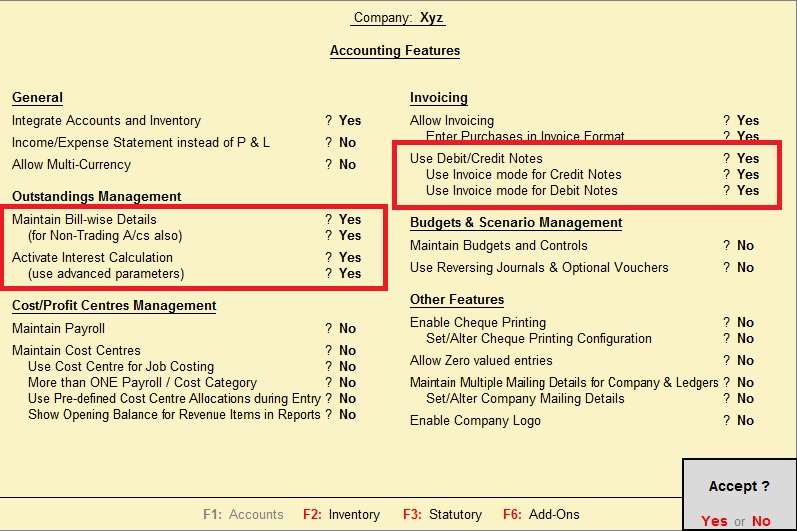

To Activate Bill Wise Details, Interest Calculation and Debit/Credit Note: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F2 (Inventory Features).

Now create ledger:-

Path for ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

Now create stock master:-

To Create Stock Group: - G.O.T. (Gateway of Tally)--> Inventory Info--> Stock Group--> Create.

To Create Stock Item: - G.O.T. (Gateway of Tally)--> Inventory Info--> Stock Item--> Create.

Now do voucher entry as follow:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F8 (Sales Voucher).

And now do the voucher entry.

Press F6 to open Receipt Voucher.

When the voucher opens, press F2 and change the date as given below:-

And then press “enter” and fill the voucher.

Accept the voucher and again press F2 and change the date.

Accept the voucher and again change the date by pressing F2 key.

View the ledger interest of Arun as follow:-

Path for view interest calculation: - G.O.T. (Gateway of Tally)--> Display--> Statement of Account--> Interest Calculation--> Ledger--> Arun.

Now create voucher type as follow:-

Path for voucher type creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Voucher Type--> Alter.

When you will press “enter” key on “Alter”, a list of voucher types will be open. You will select there “Debit Note” as follow:-

Press “enter” key on “Debit Note” and a form will open, fill as follow:-

Press “enter” after filling the name of class and then as follow:-

Press “enter”.

Accept the voucher by pressing “enter” key or “y”.

Now again do voucher entry:-

Now do voucher entry as follow:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press Ctrl + F9 (Debit Note Voucher).

Press “enter” on “Interest Receivable” and the voucher will be opened as follow:-

Accept the voucher.

After that, press F6 to open Receipt Voucher:-

Now view the ledger interest of Arun:-

Path for view interest calculation: - G.O.T. (Gateway of Tally)--> Display--> Statement of Account--> Interest Calculation--> Ledger--> Arun.

You can see that the ledger interest of Arun is blank. It shows that all the instalments have been paid.